Introduction

Mining is no longer just about extracting resources from the earth—it’s about redefining how these resources power the industries of tomorrow. As the world moves toward a cleaner, greener, and more connected future, the mining industry stands at the crossroads of tradition and innovation. With its roots deeply embedded in fueling industrial growth, mining is now evolving to meet the demands of a new era driven by sustainability and technological transformation.

In India, this shift is more pronounced than ever. While traditional materials like coal, iron ore, and bauxite continue to drive infrastructure and industrial development, the growing demand for critical minerals—like lithium and rare earth elements—has opened up entirely new opportunities. These materials are essential for emerging technologies such as electric vehicles, renewable energy systems, and advanced electronics. The narrative of mining is no longer just about extraction but about innovation, value creation, and responsibility.

This report explores how the Indian mining sector is embracing the future by leveraging cutting-edge technologies, fostering sustainability, and empowering startups to address age-old challenges. From the adoption of AI and automation to eco-friendly practices and blockchain-driven transparency, the industry is undergoing a transformation that is redefining its global significance.

With a renewed focus on public-private collaborations, digital innovation, and green mining practices, the Indian mining sector is uniquely positioned to not only meet the demands of today but also shape the possibilities of tomorrow. This is a story of resilience, adaptability, and the enduring relevance of an industry that has always been the backbone of human progress.

Executive Summary

The mining industry in India serves as the backbone of its industrial economy, facilitating rapid urbanization, infrastructure development, and the transition toward renewable energy. With vast reserves of coal, iron ore, bauxite, and critical minerals like lithium and rare earth elements, India is positioned as one of the leading global mining hubs.

Key Findings-

- Economic Contribution: The mining sector contributes 2.5% to India's GDP, with potential to increase significantly through modernization and reforms. It provides direct employment to over 700,000 workers, with an extended ecosystem supporting millions indirectly.

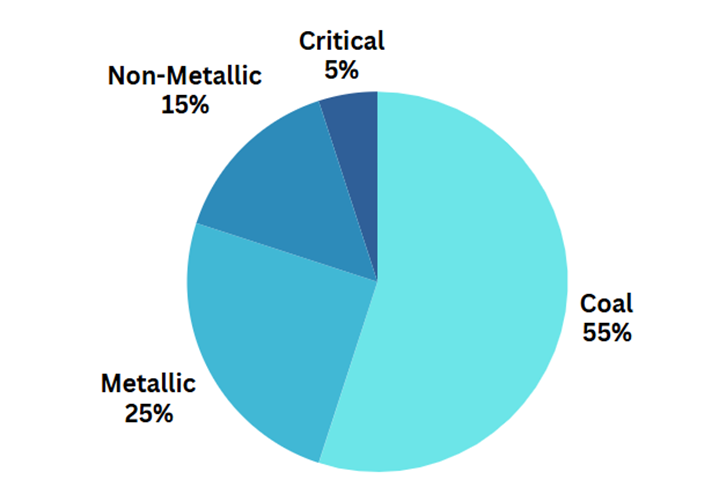

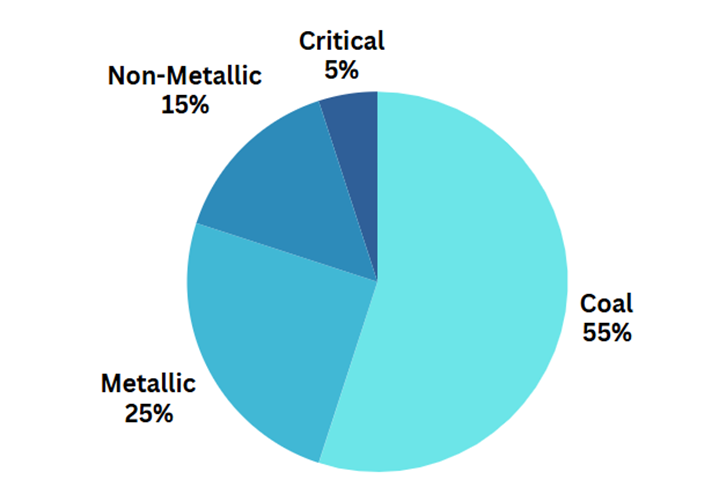

- Market Size & Growth: In 2023, the mining market was valued at ₹1,045,000 crore and is projected to grow at a CAGR of 6% through 2030. Coal remains the dominant segment, accounting for over 55% of the market, while critical minerals are set to become the fastest-growing category.

- Trends Shaping the Industry:

- Increasing private participation and FDI due to policy reforms like the National Mineral Policy (2019) and amendments to the MMDR Act.

- Adoption of smart mining technologies, including AI, IoT, and automation, to improve efficiency and reduce environmental impacts.

- Focus on sustainable mining practices and ESG compliance in response to global environmental concerns.

Competitive Landscape

The industry is dominated by public sector enterprises such as Coal India Limited (CIL) and NMDC, along with private players like Vedanta and Hindalco. Startups focusing on eco-friendly and tech-driven mining practices are emerging as disruptors. Global players are eyeing joint ventures in India, especially in critical minerals.

Industry Overview

Definition and Key Segments

Mining involves the exploration, extraction, and processing of minerals for various industrial uses. In India, the industry is categorized into:

- Fuel Minerals: Coal, lignite.

- Metallic Minerals: Iron ore, bauxite, copper, zinc.

- Non-Metallic Minerals: Limestone, gypsum, silica.

- Critical Minerals: Lithium, cobalt, and rare earth elements.

Economic Contribution

- The mining sector contributes 2.5% to India’s GDP but has the potential to increase to 5% with targeted reforms.

- It provides direct employment to over 700,000 workers, with an extended ecosystem supporting millions indirectly.

- It directly employs 7-8% of the industrial workforce, with significant contributions from mining-intensive states like Odisha, Chhattisgarh, and Jharkhand.

- Regionally, mining hubs have driven socio-economic development, providing infrastructure and employment in underdeveloped areas.

Historical and Current Context

- Historical Background: Mining in India has been traditionally dominated by public sector enterprises, with Coal India Limited controlling over 80% of coal production. Liberalization in the 1990s introduced private players into the sector.

- Current Scenario:

- Policy reforms such as 100% FDI in mining have opened avenues for international collaboration.

- India's mineral production is ranked second globally in coal and fourth in iron ore, positioning it as a key global supplier.

- However, regulatory bottlenecks and illegal mining continue to challenge the industry’s full potential.

Definition and Key Segments

The mining industry in India encompasses the exploration, extraction, and processing of minerals that are vital for industrial and economic activities. With a diverse mineral base, India is one of the top producers of both fuel minerals (e.g., coal, lignite) and metallic minerals (e.g., iron ore, bauxite, copper). Emerging critical minerals like lithium and rare earth elements are now drawing significant attention due to their importance in renewable energy and technological advancements.

Key segments of the industry include:

- Fuel Minerals: Coal, lignite, and uranium, essential for power generation.

- Metallic Minerals: Iron ore, bauxite, manganese, and copper, critical for steel production and other industrial applications.

- Non-Metallic Minerals: Limestone, gypsum, and silica, widely used in construction and cement industries.

- Critical Minerals: Lithium, cobalt, and rare earth elements, pivotal for energy storage and electric vehicles (EVs).

Economic Contribution

The mining sector contributes 2.5% to India’s GDP, with potential to reach 5% through strategic reforms. The industry is an economic catalyst in mining-intensive states such as Odisha, Chhattisgarh, and Jharkhand, driving regional growth through employment generation and infrastructure development. Approximately 7-8% of India’s industrial workforce is employed directly or indirectly by the mining sector, making it a cornerstone for both urban and rural economic sustenance.

Historical and Current Context

Mining has been integral to India’s industrial journey, historically dominated by public sector enterprises like Coal India Limited (CIL) and NMDC. However, recent policy shifts are opening the sector to private and foreign investments:

- Liberalization of the 1990s: Paved the way for private sector involvement in mining operations.

- Current Landscape: India is now the second-largest coal producer and fourth-largest iron ore producer globally, reflecting its critical role in meeting domestic and international demand.

While public enterprises remain dominant, the sector is witnessing increasing competition, particularly in high-demand areas like critical minerals. However, challenges such as regulatory bottlenecks, illegal mining, and environmental concerns persist, limiting the industry’s full potential.

Market Size and Growth

Market Size

- The Indian mining market was valued at approximately ₹1,045,000 crore in 2023, with coal, iron ore, and bauxite being the top contributors.

- Coal dominates the sector, accounting for 55% of revenues, followed by metallic minerals at 25% and non-metallic minerals at 15%. Critical minerals currently hold a smaller share but are expected to grow rapidly.

Growth Drivers

- Urbanization and Infrastructure:

- Massive investments in housing, railways, and highways are fueling demand for steel and cement, boosting mining activities.

- Renewable Energy Transition:

- Growing adoption of solar energy and EVs is driving demand for lithium, cobalt, and rare earth elements.

- Policy Support:

- Initiatives like Make in India and Atmanirbhar Bharat are encouraging domestic production and reducing import dependencies.

Projections

- The market is expected to grow at a CAGR of 6% from 2025 to 2030, driven by demand from infrastructure, renewable energy, and technological adoption.

- Critical minerals are projected to grow at a CAGR of 12%, with India actively pursuing domestic exploration and international partnerships for lithium and rare earth elements.

Market Size

The Indian mining industry witnessed steady growth in FY24, driven by robust demand across infrastructure, power generation, and manufacturing sectors. The total market value for the mining industry was estimated at ₹1,175,000 crore during FY24, reflecting a growth trajectory aligned with government initiatives and increased domestic consumption.

- Coal: Remained the dominant segment, accounting for ₹650,000 crore (55%) of the industry’s revenue. This is largely due to its critical role in India’s energy production, meeting 70% of the country’s electricity needs.

- Metallic Minerals: Contributed ₹290,000 crore (25%), driven by strong demand for iron ore from the steel industry, which supports large-scale infrastructure projects.

- Non-Metallic Minerals: Represented ₹175,000 crore (15%), led by limestone, which forms the backbone of the cement industry.

- Critical Minerals: Although still a nascent segment, critical minerals like lithium and rare earth elements experienced a rapid surge, with increased exploration and demand for EV batteries and renewable energy technologies.

Market Share Breakdown: India’s Mining Industry by Mineral Type

Growth Trends

- Coal Production Growth:

- India produced 893 million tons of coal in FY24, representing a 14% year-on-year (YoY) increase. Public sector entities like Coal India Limited (CIL) played a significant role, achieving record production levels to meet rising energy demands.

- Iron Ore Export Resurgence:

- The relaxation of export duties on iron ore boosted exports, particularly to China, contributing to a 6% increase in iron ore production YoY.

- Critical Minerals Exploration:

- The Indian government prioritized critical minerals, with significant exploration activities initiated for lithium in Jammu and Kashmir and rare earth elements in Odisha.

Growth Drivers

- Policy Initiatives:

- The government’s Atmanirbhar Bharat initiative and amendments to the MMDR Act continued to incentivize private sector participation and foreign direct investment (FDI).

- Auctioning of coal blocks and mineral mines increased transparency and competition in the industry.

- Infrastructure Development:

- Massive infrastructure projects under the PM Gati Shakti program and the National Infrastructure Pipeline (NIP) led to a surge in demand for cement, steel, and other raw materials.

- Energy Transition:

- India’s ambitious renewable energy targets, including 500 GW of non-fossil fuel capacity by 2030, drove demand for lithium, cobalt, and other critical minerals, boosting growth in this emerging segment.

Projections Beyond FY24

- Market Growth: The mining sector is expected to grow at a CAGR of 6% from FY24 to FY30, supported by sustained demand in infrastructure and renewable energy sectors.

- Critical Minerals Boom: Critical minerals, particularly lithium, are projected to grow at a CAGR of 12%, as India focuses on reducing dependency on imports and develops domestic exploration capabilities.

- Digital Transformation: The adoption of automation, AI, and IoT is expected to enhance mining productivity, reduce operational costs, and support sustainable practices.

With strong government backing, private investments, and increasing global demand for minerals, FY24 marked a pivotal year for the Indian mining industry, setting the stage for accelerated growth in the coming years.

Market Segmentation

By Mineral Type

- Coal: The largest segment, accounting for 55% of market revenues, remains critical for India’s energy production. However, the transition to renewable energy is pushing the industry to adopt cleaner coal technologies like coal gasification and carbon capture.

- Iron Ore: Essential for steel production, iron ore demand is driven by infrastructure development and industrial growth. India's focus on green steel production is likely to influence extraction practices.

- Bauxite: Used primarily for aluminum production, this segment is poised for growth with increased demand for lightweight materials in automotive and aerospace industries.

- Limestone: Central to cement production, limestone mining is experiencing steady growth due to large-scale infrastructure projects under the PM Gati Shakti plan.

- Rare Earth Elements (REEs): A rapidly growing segment due to their importance in renewable energy technologies, EV batteries, and electronics. Startups like Metastable Materials are focusing on REE recycling and extraction from unconventional sources.

By Application

- Power Generation: Coal continues to dominate, but renewable energy technologies are creating demand for minerals like lithium and rare earth elements.

- Construction: Cement and steel demand are driving limestone and iron ore mining, supported by projects like the National Infrastructure Pipeline.

- Manufacturing: Aluminum, copper, and other metallic minerals are vital for automotive, electronics, and machinery manufacturing.

- Renewable Energy: Critical minerals such as lithium and cobalt are central to the production of batteries, solar panels, and wind turbines, driving innovation in extraction and processing.

By Geography

- Odisha: Largest producer of iron ore and bauxite, and an emerging hub for rare earth exploration.

- Jharkhand: Known for coal and iron ore mining, with significant government and private sector investments.

- Chhattisgarh: A key player in coal and limestone mining, contributing heavily to cement production.

- Rajasthan and Andhra Pradesh: Leaders in non-metallic minerals like gypsum and rare earth elements.

By Stakeholder

- Public Sector Enterprises: Dominated by Coal India Limited (CIL), which controls over 80% of India’s coal production.

- Private Companies: Major players like Vedanta, Hindalco, and Tata Steel are adopting sustainable and tech-driven mining practices.

- Startups: Emerging players like Earthmovers Technologies and Metastable Materials are leveraging automation and AI for resource efficiency and sustainability.

Market Trends and Opportunities

Sustainability Trends

- Green Mining Practices: Companies are adopting methods like reduced blasting, water recycling, and renewable energy integration into operations.

- ESG Compliance: Adherence to global ESG standards is becoming a prerequisite for investments, with mining companies introducing comprehensive sustainability frameworks.

Technological Innovations

- Automation and AI: Autonomous vehicles, drones, and AI-driven analytics are transforming exploration, extraction, and processing.

- IoT and Digital Twinning: IoT sensors and digital twins allow real-time monitoring of mine operations, ensuring safety and efficiency.

- Advanced Beneficiation: Innovations in ore processing are reducing waste and improving yield, particularly in low-grade ores.

Growth Opportunities

- Rare Earth Minerals and Lithium: India is ramping up exploration and refining capabilities for these minerals to support its EV and renewable energy ambitions.

- Private and Foreign Investments: Reforms allowing 100% FDI and streamlined auction processes have attracted interest from global mining firms.

- Tech-Driven Startups: Startups focusing on resource efficiency and sustainability are attracting significant venture capital.

Challenges and Threats

Regulatory and Infrastructure Challenges

- Policy Bottlenecks: Delays in environmental clearances and land acquisition continue to hinder mining projects.

- Infrastructure Gaps: Poor transport and logistics infrastructure in mining regions increases costs and limits scalability.

Environmental Concerns

- Impact on Ecosystems: Mining activities often lead to deforestation, water contamination, and loss of biodiversity, prompting stricter regulatory oversight.

- ESG Pressures: Investors are demanding higher environmental and social responsibility, requiring companies to adapt quickly.

Operational Challenges

- Illegal Mining: Unregulated mining activities undermine legitimate operations and cause revenue losses for the government.

- Commodity Price Volatility: Fluctuations in global prices for minerals like coal, iron ore, and lithium can impact profitability.

PESTEL Analysis of the Indian Mining Industry

Political

- Government Reforms and Policies:

- The MMDR Act (2015) introduced transparent auction mechanisms for mining leases, encouraging private investment and competition. Recent amendments have enabled 100% FDI in commercial coal mining, fostering international collaborations.

- The National Mineral Policy (2019) emphasizes sustainable mining, increasing mineral exploration, and reducing import dependence for strategic minerals like lithium and cobalt.

- Case Study:

- In 2023, the Indian government auctioned coal blocks under a commercial mining initiative, inviting global giants to boost production. As a result, companies like Adani Enterprises increased their stake in the industry, leveraging technology for operational efficiency.

Economic

- Contribution to GDP: The mining sector contributes 2.5% of GDP, with ambitions to grow to 5% through reforms. States like Odisha and Jharkhand benefit heavily from royalties and taxes on mineral production.

- Future Investments: The government plans to attract over ₹2.5 lakh crore in private and foreign investments by 2030 for critical mineral exploration and digital mining technologies.

- Startups Driving Efficiency:

- Minereye uses AI to optimize resource allocation, lowering production costs while improving yield.

Social

- Employment: Mining provides direct and indirect employment to over 2.2 million workers, particularly in rural and tribal areas.

- Community Development: Mining companies like Vedanta and NMDC invest in CSR activities, building schools, healthcare facilities, and infrastructure in mining-dependent regions.

- Challenges: Social resistance to mining projects due to displacement and environmental concerns often delays operations.

Technological

- Innovations Transforming the Industry:

- Automation and AI: Autonomous vehicles and AI-powered equipment are reducing human risk and improving efficiency.

- IoT and Predictive Analytics: Companies like Coal India Limited have started using IoT sensors for real-time monitoring of mining equipment and predictive maintenance.

- Digital Twins: Hindalco recently adopted digital twin technology for its aluminum refineries, optimizing output while reducing environmental impact.

- Startups Innovating: Metastable Materials recycles lithium and cobalt from battery waste, reducing dependency on imports for critical minerals.

Environmental

- Regulations and Implications:

- Strict environmental regulations mandate environmental impact assessments (EIAs) and sustainable practices in mining operations.

- The Environmental Protection Act (1986) enforces compliance on water and air quality standards in mining regions.

- Green Mining Practices:

- Vedanta introduced low-emission smelting technologies in zinc mining, cutting emissions by 20%.

- Recycling: Companies like Tata Steel are investing in slag recycling and water conservation technologies.

- Compliance Standards:

- Adhering to ESG (Environmental, Social, Governance) frameworks is becoming critical for companies seeking global investments. Initiatives like carbon-neutral mines and renewable energy-powered operations are gaining momentum.

Environmental Case Study:

- Eco-Friendly Coal Mining by Adani: The Carmichael Coal Mine project in Australia implemented solar-powered equipment and strict water recycling policies, setting a benchmark for sustainable practices in coal mining.

Legal

- Policy Landscape:

- The Mines Act (1952) and Mines Rules (1955) set operational safety standards, mandating the use of protective gear and regular inspections.

- National Green Tribunal (NGT): Acts as a watchdog for enforcing environmental laws in mining operations.

Future Outlook of the Indian Mining Industry

Emerging Trends

- Critical Minerals: The Next Frontier

With growing demand for lithium, cobalt, and rare earth elements, India's focus has shifted toward becoming a global player in the supply of these essential resources. The 5.9 million tonnes of lithium reserves in Jammu and Kashmir, discovered in 2023, mark a turning point. Strategic partnerships with countries like Australia and Argentina are bolstering India's critical mineral ambitions. - Sustainable Mining Practices

The industry is increasingly adopting green mining techniques and circular economy models to reduce its ecological footprint.- Case Study: Tata Steel

Tata Steel has set benchmarks in sustainable mining by incorporating mine-to-mill optimization and deploying slag recycling technologies, which reduce waste while increasing operational efficiency. - Success Story: Vedanta’s Green Zinc Initiative

Vedanta Resources implemented low-emission smelting technologies at its zinc mines, cutting greenhouse gas emissions by 20% and setting new sustainability standards in the base metals sector.

- Digital Transformation and Startups

- Automation and AI: Players like Hindalco are using digital twin technology to optimize their aluminum refining processes, enhancing efficiency while reducing energy consumption.

- Startups Driving Change:

- Metastable Materials: Innovating in the recycling of lithium and cobalt from EV batteries, reducing India’s reliance on raw imports.

- Minereye: Using AI-powered analytics to optimize mine planning and enhance safety.

- Earthmovers Technologies: Specializes in predictive maintenance for mining equipment, reducing downtime and enhancing productivity.

- Public-Private Partnerships (PPPs)

- Critical Mineral Exploration: PPPs between the government and private enterprises like Vedanta and Hindustan Zinc have accelerated rare earth element and lithium mining projects.

- Infrastructure Development: Collaborative efforts in mining states like Odisha and Chhattisgarh are enabling better logistics, reducing transportation costs, and increasing efficiency.

Indian Startups Transforming the Mining Industry

The Indian mining sector is undergoing a transformative shift, driven by innovative startups that are reimagining traditional practices. These companies are addressing some of the most critical challenges in the industry—resource inefficiency, environmental impact, and operational delays—through cutting-edge technologies and sustainable solutions. By focusing on automation, AI, blockchain, and eco-friendly processes, these startups are positioning India’s mining sector as a global leader in innovation and sustainability. Below are some of the key players leading this transformation:

1. Metastable Materials

- Focus: Urban mining and critical mineral recycling.

- Innovation: Metastable Materials specializes in recovering critical minerals like lithium, cobalt, and rare earth elements from discarded electronic waste and EV batteries. Their proprietary recycling process ensures high efficiency and minimal waste, making it a vital contributor to India’s circular economy.

- Operations and Impact:

- Metastable Materials is filling the critical mineral gap in India, which heavily depends on imports for these resources.

- Their recycling technologies provide a sustainable alternative to traditional mining, significantly reducing environmental degradation.

- They are partnering with leading EV manufacturers and electronics companies to create closed-loop systems, ensuring raw materials are continually recycled.

- Future Potential: The startup plans to expand its operations across India and export recycled minerals to international markets, making India a hub for critical mineral recycling.

2. Earthmovers Technologies

- Focus: Predictive maintenance for mining equipment.

- Innovation: Earthmovers Technologies uses IoT sensors and AI-powered algorithms to monitor mining equipment in real time. Their predictive maintenance solutions help operators identify potential breakdowns before they occur, reducing downtime and improving resource efficiency.

- Operations and Impact:

- The startup works with coal and iron ore mines, where unplanned equipment failures often cause significant production delays.

- Their solutions reduce maintenance costs by 20-30% and increase equipment lifespan, leading to overall operational efficiency.

- Earthmovers has successfully implemented its technologies in mining hubs like Jharkhand and Odisha, earning praise for its cost-saving impact.

- Future Potential: With plans to integrate autonomous technologies and machine learning, Earthmovers aims to transform equipment management into a fully automated, AI-driven process, making it a leader in mining technology solutions.

3. Minereye

- Focus: AI-powered resource optimization and drone-based exploration.

- Innovation: Minereye combines AI and drone technologies to improve resource mapping and enhance safety in mining operations. Their AI-driven analytics provide precise mineral data, reducing resource wastage, while their drone-based exploration reduces the time and cost of on-ground surveys.

- Operations and Impact:

- Minereye’s resource optimization technology has increased resource extraction efficiency by up to 20% in operational mines.

- Their real-time safety monitoring systems detect hazardous conditions, reducing workplace accidents in high-risk environments.

- They have partnered with state governments and private miners to implement their solutions in iron ore and limestone mines in Odisha and Chhattisgarh.

- Future Potential: Minereye aims to expand its resource optimization services to rare earth element exploration, aligning itself with India’s critical mineral needs. They are also working on scaling AI-powered safety systems to underground mining operations.

4. EcoMine Technologies

- Focus: Environmentally friendly mineral extraction.

- Innovation: EcoMine Technologies develops biodegradable chemicals for mineral extraction, replacing traditional toxic chemicals used in mining processes. Their solutions are particularly impactful in bauxite and rare earth element extraction, where water contamination is a significant concern.

- Operations and Impact:

- The startup’s chemical solutions reduce the environmental damage caused by mining activities, ensuring compliance with strict ESG standards.

- EcoMine has partnered with companies like Vedanta to scale its technologies in large-scale operations, particularly in Rajasthan’s zinc mines.

- Their methods have significantly improved water recycling rates in mining operations, helping companies achieve sustainability goals.

- Future Potential: EcoMine plans to expand its product line to include solutions for coal and metallic mineral extraction, making sustainable practices accessible across the industry.

5. Chariot Innovations

- Focus: Blockchain-driven supply chain transparency.

- Innovation: Chariot Innovations uses blockchain technology to create a transparent and traceable supply chain for minerals. This ensures ethical sourcing and eliminates concerns around illegal mining or human rights violations.

- Operations and Impact:

- Their blockchain solutions enable companies to provide end-to-end traceability for minerals, aligning with global ESG standards.

- Chariot Innovations has collaborated with mining companies exporting minerals to Europe, where supply chain transparency is a regulatory requirement.

- By ensuring that minerals are sourced responsibly, the startup is building trust with investors and international buyers.

- Future Potential: Chariot Innovations plans to integrate AI and IoT data into its blockchain systems, offering real-time insights into the movement and environmental impact of minerals.

Sustainable Mining Initiatives

- Vedanta’s Water Stewardship Program

Vedanta’s zinc mines in Rajasthan have implemented 100% water recycling, ensuring zero wastewater discharge and reducing stress on local water resources. - Tata Steel’s Circular Economy Model

Tata Steel has pioneered slag recycling, which transforms mining byproducts into construction materials, reducing waste while providing a cost-effective alternative to natural aggregates. - Startups Enabling Sustainability:

- Metastable Materials focuses on recovering critical minerals like lithium and cobalt from industrial waste, reducing environmental degradation.

- EcoMine Technologies is developing biodegradable chemicals for mineral extraction, eliminating toxic byproducts.

Strategic Recommendations for Companies and Investors

- Invest in Critical Minerals:

Companies should prioritize lithium, cobalt, and rare earth exploration, aligning with India’s renewable energy goals. Investors should back startups focusing on recycling and clean extraction technologies. - Leverage Advanced Technologies:

- Adopt AI-driven predictive analytics, autonomous vehicles, and IoT-based systems to enhance efficiency and reduce operational risks.

- Scale up digital twin technologies to simulate and optimize operations in real-time.

- Focus on ESG Compliance:

- Develop strong ESG frameworks to attract international investments.

- Integrate renewable energy into mining operations to align with global sustainability trends.

- Expand Public-Private Partnerships (PPPs):

- Collaborate with the government for access to resources, subsidies, and infrastructure support.

- Engage in joint ventures to scale exploration activities in underdeveloped regions like the Northeast and Jammu and Kashmir.

Opportunities and Projections

- Market Growth: The mining industry is expected to grow at a CAGR of 6-8% between 2025 and 2030, with critical minerals leading the charge at a 12% CAGR.

- Infrastructure Development: PPPs will play a pivotal role in upgrading infrastructure in mining-intensive states, reducing transportation costs and improving logistics.

- Global Partnerships: Collaborations with Australia, Chile, and Argentina for lithium and rare earth sourcing will ensure supply chain resilience.

Conclusion

The future of mining in India lies in balancing sustainability, technological innovation, and resource optimization. Public-private partnerships, startup-driven innovations, and successful sustainable initiatives by major players will redefine the industry’s trajectory. By aligning operations with global trends in critical minerals and green technologies, India’s mining sector can secure its place as a global leader in sustainable mining.